osceola county property tax rate

9202021 43700 PM. Learn how Osceola County levies its real property taxes with our detailed review.

Focus Parent Portal Letter School District Of Osceola County

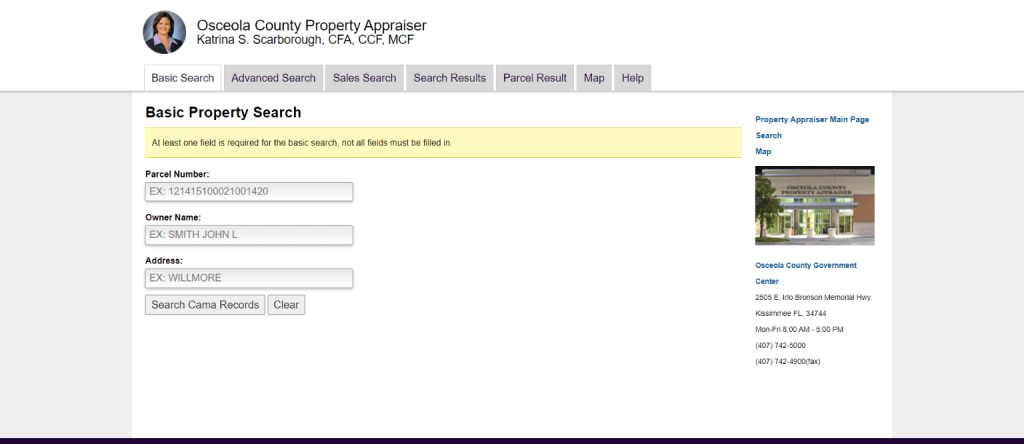

Search Use the search critera below to begin searching for your record.

. Florida provides taxpayers with a variety of exemptions that may lower propertys tax bill. 2021 OSCEOLA COUNTY PROPERTY TAX. Search by Name through Property Building Department and Tax Records.

Irlo Bronson Memorial Hwy. OSCEOLA COUNTY TAX COLLECTOR. 407-742-4037 Property Taxes FAX.

Osceola County Residential Impact Fee Rates Created Date. Under Florida law e-mail addresses are public records. The enclosed tax notice covers ad valorem taxes for the calendar year January 1 2021 through December 31 2021 and non-ad valorem taxes for the fiscal year October 1 2021 through September 30 2022.

Osceola County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property. Step 1. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email Cart.

407-742-4009 Local BusinessTourist Tax. Ad Valorem taxes on real property are collected by the Tax Collector on an annual basis collection begins on November 1st for the current year January through December. Please correct the errors and try again.

If you do not want your e-mail address released in response to a public records request do not send electronic mail to this entity. OSCEOLA COUNTY TAX COLLECTOR. I have taken the liberty of linking a copy of the tourist tax form f or your convenience here.

OSCEOLA COUNTY TAX COLLECTOR. 407-742-4037 Property Taxes FAX. Current tax represents the amount the present owner pays including exemptions.

File the Osceola County Tourist Development Tax Application. Winter taxes are due by February 14 without penalty. Osceola Tax Collector Website.

When are taxes due. If you are considering becoming a resident or only planning to invest in the countys real estate youll come to know whether Osceola County property tax regulations are helpful for you or youd rather look for another location. Visit their website for more information.

Pay 5 fee to mail into Bruce Vickers Osceola Tax Collector. Pay Property Taxes Online in Osceola County Michigan using this service. Osceola County Courthouse 300 7th Street Sibley Iowa 51249 712 754-2241.

Property Appraisers Office 2505 E Irlo Bronson Memorial Hwy Kissimmee FL 34744. Osceola County Tax Collector Property Search. Irlo Bronson Memorial Hwy.

Osceola Iowa 50213 TAX RECEIPT Payment of first half of real estate taxes is payable to the Village of Osceola by January 31st of each year Pro members in Osceola County FL can access Advanced Search criteria and the Interactive GIS Map Oak Street Suite 102 Wauchula FL 33873 Oak Street Suite 102. If you have trouble filling this out comment below. Osceola County Clerk of the Circuit Court Kelvin Soto 2 Courthouse Square Kissimmee Florida 34741 407 742-3500.

If you are contemplating taking up residence there or only planning to invest in Osceola County property youll learn whether the countys property tax laws are helpful for. Osceola County Florida Property Search. Property owners are required to pay property taxes on.

Osceola County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax. Summer taxes are due by September 14 without interest. On average Osceola County residents pay about 348 of their yearly income on their property tax.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email. This property is fully exempted from paying taxes. 407-742-4009 Local BusinessTourist Tax BRUCE VICKERS CFC CFBTO ELC.

Parcel Number Search by Parcel Number through Property Building Department and Tax Records. Economic Development Commission 300 7th Street Sibley Iowa 51249 712 754-2523. 407-742-3995 Driver License Tag FAX.

Tonia Hartline 301 W. 407-742-3995 Driver License Tag FAX. These are deducted from the assessed value to give the propertys taxable value.

The median property tax also known as real estate tax in Osceola County is 114800 per year based on a median home value of 10110000 and a median effective property tax rate of 114 of property value. With this resource you will learn helpful knowledge about Osceola County property taxes and get a better understanding of things to consider when it is time to pay. The median property tax also known as real estate tax in Osceola County is 188700 per year based on a median home value of 19920000 and a median effective property tax rate of 095 of property value.

The Tax Collectors Office provides the following services. Search all services we offer. Osceola County has relatively high median property taxes with the property tax being around 095 of the propertys assessed fair market value.

All taxes become delinquent to the County Treasurer on March 1 with additional penalties and interest.

Osceola County Property Appraiser How To Check Your Property S Value

Osceola County Property Appraiser Katrina S Scarborough Cfa Ccf Mcf Facebook

Osceola County Property Appraiser How To Check Your Property S Value

Osceola County Property Appraiser Katrina S Scarborough Cfa Ccf Mcf Facebook

Focus Parent Portal Letter School District Of Osceola County

David Weekly Townhouse Home Owners Association Fees In Spring Lake Celebration Fl Spring Lake Lake Garden Celebration Fl

Osceola County Property Appraiser Katrina S Scarborough Cfa Ccf Mcf Facebook

Osceola County Fl Property Tax Search And Records Propertyshark

Distrito Escolar Del Osceola County School District

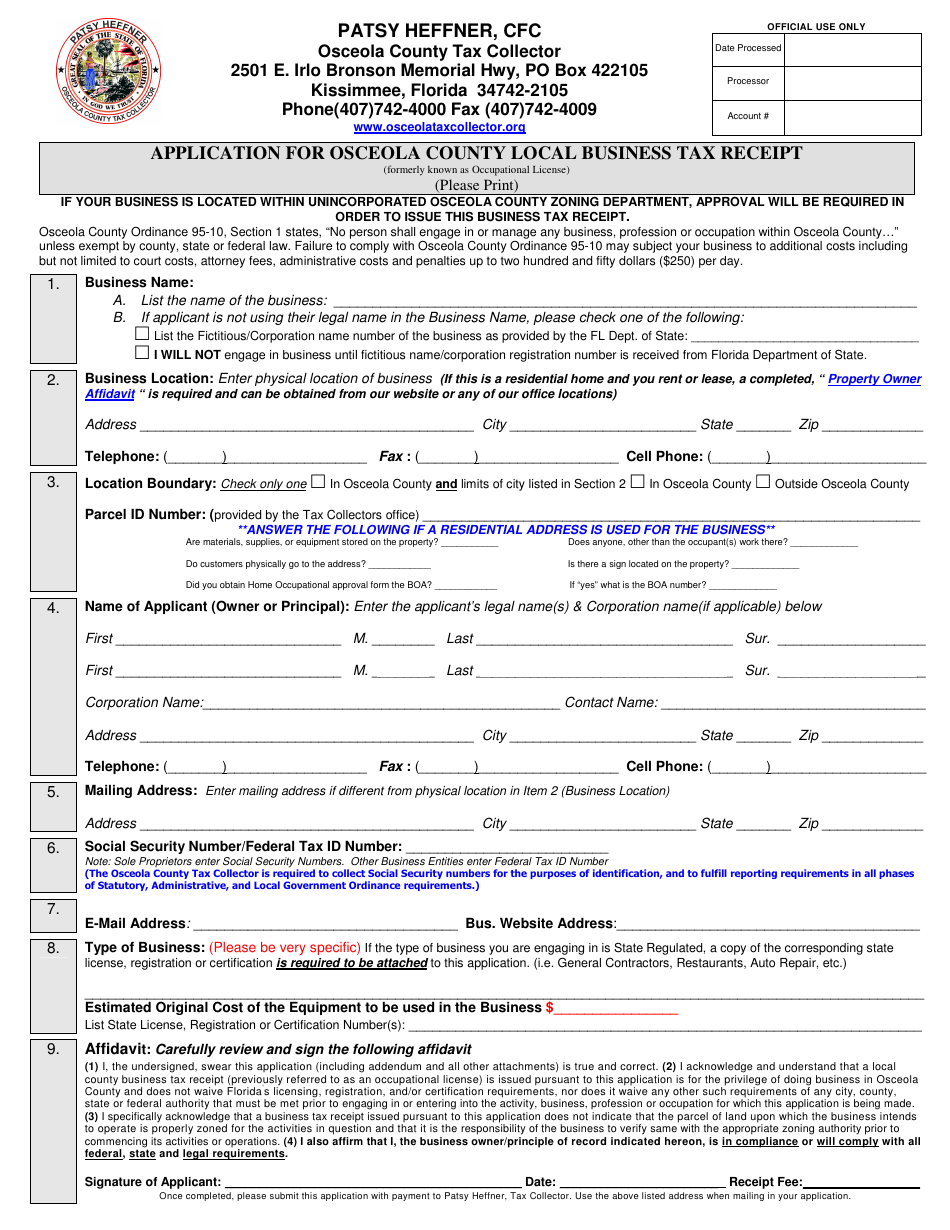

Osceola County Florida Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller

Grand Orlando Resort At Celebration Kissimmee Fl Us Meetings And Events Cvent

Osceola County Florida Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller

David Weekly Townhouse Home Owners Association Fees In Spring Lake Celebration Fl Spring Lake Lake Garden Celebration Fl

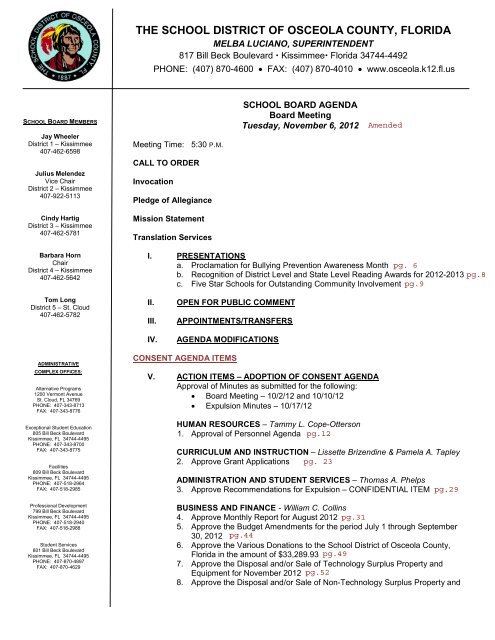

School Board Meeting Agenda Packet Osceola County

Osceola County Property Appraiser How To Check Your Property S Value

Free Credit Report Offers Extended Complaints Have Increased Florida Realtors In 2021 Credit Score Check Credit Score Better Credit Score